I read two reports recently that made me resurrect my previous thoughts about a flat tax rate for the United States.

The concept of a flat tax rate is that everyone – individuals, corporations and any other institution that is not directly beneficial to their community in a non-profit way – should pay, say, 10% of their income with no deductions and no exceptions. If you earn $10,000 a year, you pay $1,000; if you earn $10 million, you pay $1 million. It’s not a new idea by any means, and it would involve a huge re-alignment of the tax system, but it would mean that everyone pays their fair share. Obviously, it would not be quite as easy as it sounds, and the lobbying forces that would immediately be galvanized against it would be significant, but it remains the most equitable idea out there.

The two reports that prompted my return to this concept – I have written blogs about it before – were (1) a report from the U.S. AFL/CIO Union about the percentage difference between CEO and employee salaries across several countries, and (2) an analysis of the world of Pastor Joel Osteen in Houston, Texas. The abuses described in those reports were eye-opening, although not surprising, but they are only two examples of the total inequity of the current tax system.

Also, just imagine for a moment, the drastic reduction in the cost to us taxpayers of the resulting shrinking in size of the IRS, let alone the even greater reduction in costs to us because we could eliminate armies of tax accountants and tax lawyers. What a great idea!

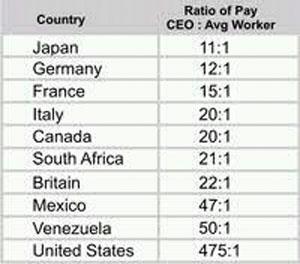

Just to give you a flavor of the abuses currently existing in the United States, this AFL/CIO report includes the following table.

Even if the numbers are inflated by the bias of the source – the AFL/CIO is a union after all – the figure for the United States is outrageous, compared to the rest of the western world.

The other report concerns the ability of individuals to exploit the current tax system. I should add here that there are abuses at all levels in between these two extremes examples so the problem is endemic.

Pastor Joel Osteen is the head/owner of the Lakewood Church in Houston, Texas. He lives in a 70,000 square-foot mansion that boasts a 20-car garage. He reputedly pays himself $54 million a year from the contributions of his followers and, since he is a church, he’s classified as non-profit, and therefore tax exempt. I have no problem with him paying himself $54 million – if people are dumb/stupid enough to give their money to outright charlatans, they deserve all they get, but tax-exempt, no way. AND Joel Osteen is just one example of the many, equally greedy, other religious charlatans. Their churches are man-made, so they should be taxed like any other man-made institution, along with their owners: Their versions of “god”, or Jesus Christ, have nothing to do with it. Wikipedia lists 114 such evangelical churches in the U.S., many of which have multiple sites – one lists 360 sites under its mantle.

It is also interesting to note that another Wikipedia report, which cites the wealthiest religious organizations, puts The Church of Jesus Christ of Latter-Day Saints (The Mormons) at the top of the worldwide list, with a value of $236 billion – I should add that Wikipedia was unable to determine the wealth of the Catholic Church, which is almost certainly far higher than all the rest put together.

CHURCHES, AND MANY OTHER NON-PROFITS (THE NRA, FOR EXAMPLE), SHOULD BE TAXED ON THEIR INCOMES LIKE EVERYONE ELSE.

Overall, I am sure that these examples are a drop in the bucket of abuses that allow many people and entities, “to not pay their fair share”. A flat tax rate would set up a structure that could address these abuses and also, at the same time, make “paying your fair share” a reality.

We can live in hope.